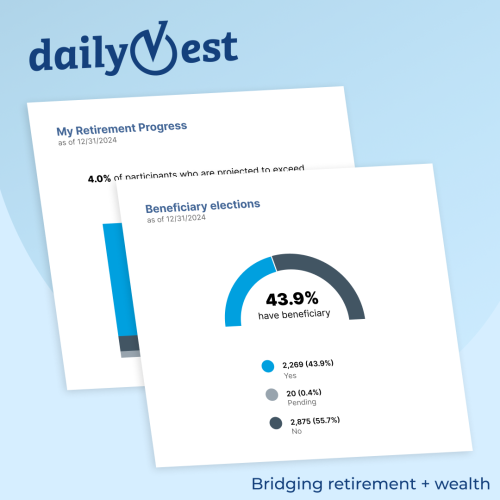

Next-gen dashboard for advisors

Personalize sales and service with instant access to plan and participant data via your dashboard.

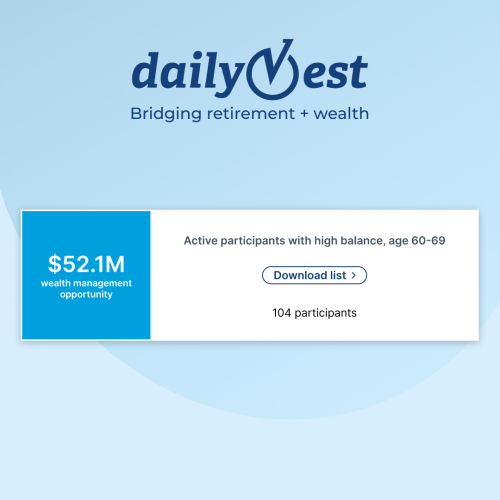

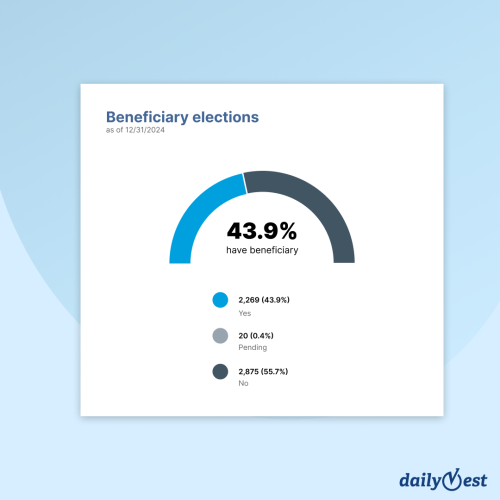

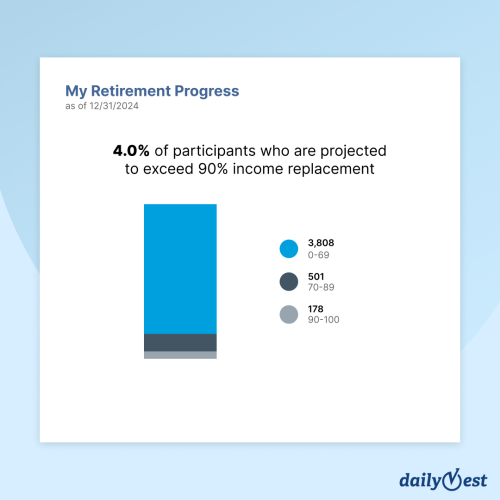

Actionable insights for providers

Instant report generation allows providers to spot trends quickly and easily.

Strategic solutions for sponsors

dailyVest gives you the power to identify the participants who need help—and how.

Solutions for every member of the team

At dailyVest, we see advisors, providers, sponsors, and participants as members of a team. So we build tools that support every teammate, from the leagues to the players. I guess that makes us something of a mascot.

Plan Advisors

As the coaches of a team, advisors wear many hats. Our unique tools and dashboard help coaches conduct outreach faster.

Providers

Stay at the top of your league with generative reporting features that quickly identify plan health & trends.

Sponsors

Sponsors hold the whole team together! dailyVest tools identifies trends and tracks plan data with no jargon.

Participants

Our tools identify the participants who are spending too much time on the bench, and why.

Detailed Reports Just A Few Clicks Away

dailyVest helps keep plan stakeholders informed with customized reports generated on-demand from your dashboard.

Value We Provide

How much plan health insight does dailyVest deliver to its clients?

…all with no PII in its cloud.

Investment & Performance Reporting for Account Access

EnterpriseROR's Personal Investment Performance ('PIP') module is a real-time investment performance calculation engine and reporting system designed to integrate within a firm's account access website—behind the firewall.

Connect Plan Data to Business Outcomes From Your Dashboard

Monitor plan performance, participation, and investment activity of participants, all within your dailyVest dashboard. Analyze financial wellness of employer-sponsored retirement plans and large investor populations.

On-demand & Batch-generated Investor Account Statements

Streamline your process by producing statements in bulk for efficient distribution to investors. Statement-On-Demand ('SOD') delivers immediate and customized account statements from your own account access website.

Print Batch Output

Firms that provide personal rate of return through the web may also need to include the same returns on printed statements, or store them for archival purposes. Print Batch Output ('PBO') meets that need efficiently, ensuring consistency and compliance with regulatory standards

Over 18,000 plans analyzed

Let’s take a look at yours next.